Amongst the various updates from the earlier edition the 2019 guide covers the GST regime in India which came into effect from 1 July 2017 to replace a number of other indirect taxes and the Sales and Service Tax regime implemented in Malaysia from 1 September 2018 which replaced the GST system. Taxable and non-taxable sales.

Gst Portal Provides Simple To Use Offline Utility For Uploading Invoice Data And Other Records For Creating Gstr 1 Accounting And Finance Worksheets Offline

Pay the correct GST and get a refund of the wrong type of GST paid earlier.

. If your store is located in Malaysia then as of October 2021 you are charged the Sales and Service Tax SST on your Shopify fees. The implementation of GST was understandable for most diners the Chinese daily spoke to and they were generally aware that a company has to register for GST when its taxable turnover exceeds 1. Also the amount of GST under Reverse charge is to be paid in cash only and can not be paid from ITC available.

Indias largest network for finance professionals. It is requested to register on AI GST portal and upload ticket details within due date to get the invoices. AGENCY Browse other government agencies and NGOs websites from the list.

Under Malaysian Tax Law both Residents and Non-Resident are subject to Income Tax on Malaysian source income. SST charged in Malaysia. The person making advance payment has to pay tax on.

This guide provides an overview of the key concepts of Singapores Goods. REGISTER LOGIN GST shall be levied and charged on the taxable supply of. Its necessary to register GST for businesses having a gross turnaround of about A75000 or more.

An Individual will be. So it is very important to identify whether you are Residents or Non-Resident in regard to Malaysia Tax Law. But interest 18 on shortfall amount.

EVENT CALENDAR Check out whats happening. Once GSTR 1 is filed invoices are sent to registered email ids captured from SSR AI GST portal and also uploaded on AI portal for download upto one year from the date of invoice. COMPLAINT.

GST Plus Track everything in GST. Aimed to simplify the process of incorporation in Malaysia and reducing the costs of compliance with Malaysian corporate law the SSM began a review of the Companies Act 1965 in 2003. Medshop offers free laser engraving and embroidery and is proud to represent some of the worlds leading Medical suppliers including 3M littmann stethoscopes.

Uploading of ticket details is not mandatory. Selling goods or services. The net result is that minimum amount of GST payable in a tax period is the amount of reverse charge in that period.

COMPLAINT. Ranked at 24 th in 2018 World Banks Ease of Doing Business Malaysia is fast gaining traction as one of the favourite investment destinations to do business in Malaysia and building a business in Malaysia. Financial transactions can also be managed using our detailed reporting modules.

REGISTER LOGIN GST shall be levied and charged on the taxable supply of. You should issue tax invoices when you sell goods or services. John can claim a GST credit of 100 on his activity statement.

Alternatively you can log in using. GST Guide On Declaration And Adjustment After 1st September 2018. For non-profit organizations its A150000 per year or more.

GST to your Shopify bill. Email Your Username Password. AGENCY Browse other government agencies and NGOs websites from the list.

GST berupaya kukuhkan semula ekonomi negara. Though the high ranking in the World Banks Ease of Doing Business signifies that starting a business in. Check With Expert GST shall be levied and charged on the taxable supply of goods and services.

Left-arm spinner Nicolaj Damgaard took 6 for 6 in a nine-over spell which included seven maidens to help bowl Malaysia out for 151 after Denmark scored 242 for 6 in a rain-reduced 49-over contest. Medshop Malaysia is the leading provider of littmann stethoscope cherokee scrubs and dermlite dermatoscopes. GSTR 20131 Goods and services tax.

A Complete Guide to Start A Business in Malaysia 2022. Travel Boutique Online offers an interactive online booking interface to travel agents and tour operators allowing them to book travel products like Hotels Flights Travel Insurance Transfers Sightseeing and Holiday Packages and IRCTC simply and quickly. You can file the GST Invoices for returns through GST portal and claim input tax credit on your business purchases.

By updating your GST number with Amazon as a Business customer you can explore lakhs of products with GST Invoices offered by Business sellers. What benefits do I get if I update my GST number with Amazon. Check With Expert GST shall be levied and charged on the taxable supply of goods and services.

If you supply or receive an invoice that only has a figure at a wine equalisation tax-goods services tax WEG label you need further information to claim GST credits and for it to be considered a valid tax invoice. Malaysia perlu bangunkan dasar sistem ambil pekerja asing. John can also claim an amount that reflects the decline in value of the photocopier on his tax return.

More 67 30062020 NEWS 11. Critical to develop foreign worker recruitment policy and system - FMM. GST Calculator Australia is a free online tool that helps you to add or subtract the Goods and Services Tax rates to any amount.

Services Tax GST system as it relates to Singapore companies definition of GST registration requirements advantages and disadvantages of GST registration filing GST returns and schemes to. More 66 01072020 Guide on Transmission and Distribution of Electricity Services. Things are even cheaper still over in East Malaysia for both saloon above and non-saloon vehicles below.

If you want to claim the GST on these purchases you will need a record of the. John subtracts his GST credit from the purchase price 1100 - 100 GST 1000 and uses 1000 to calculate the deduction he is entitled to in his tax return. Penalty for wrongfully charging GST rate charging.

Tax invoices sets out the information requirements for a tax invoice in more detail. FMM asks govt to prioritise economic recovery welcomes GST come-back. However if you register for New Zealand GST and add your Inland Revenue Department IRD number to your Shopify store then Shopify doesnt collect GST on.

You need to keep the tax invoice for your GST records. EVENT CALENDAR Check out whats happening. FMM asks govt to prioritise economic recovery welcomes GST reinstatement.

More 65 04072020 Import Duty and Sales Tax Exemption on KN95 Type Face Mask. Advance paid for reverse charge supplies is also leviable to GST. Residents and Non-Resident status will give a different tax regime on income earnedreceived from Malaysia.

Approved Major Exporter Scheme AMES Register Now More 68. Penalty for incorrect filing of GST return. After winning the toss and bowling first Malaysia put the early squeeze on Denmarks batting line-up.

SSM assumes the responsibilities to incorporate company and register business in Malaysia with its products and services that are available to the public. The same rates apply to. No penalty as such.

When you buy supplies worth 50 or less its still a good idea to get a receipt. ITC will be reversed if not paid within 6 months. Penalty for delay in payment of invoice.

Other services you will find in the interface.

Gst Registration Pan India Registration Goods And Service Tax Goods And Services Registration

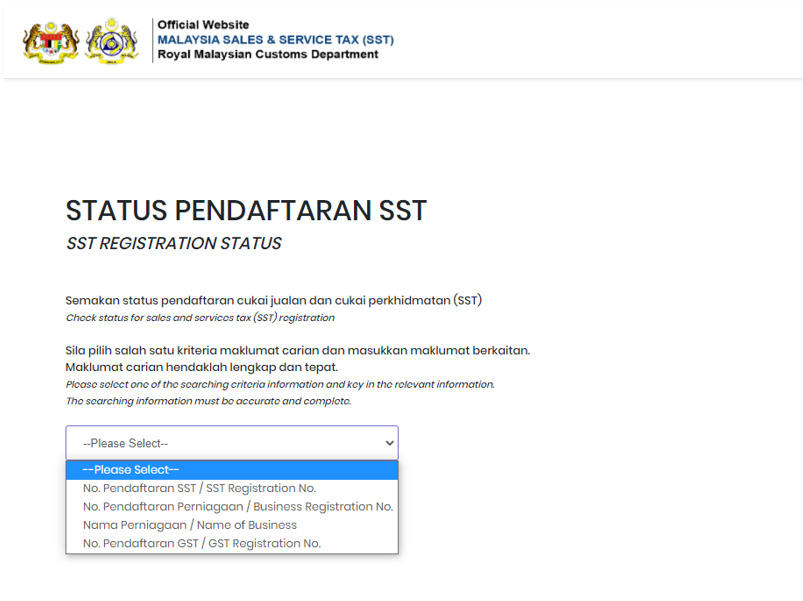

Malaysia Sst Sales And Service Tax A Complete Guide

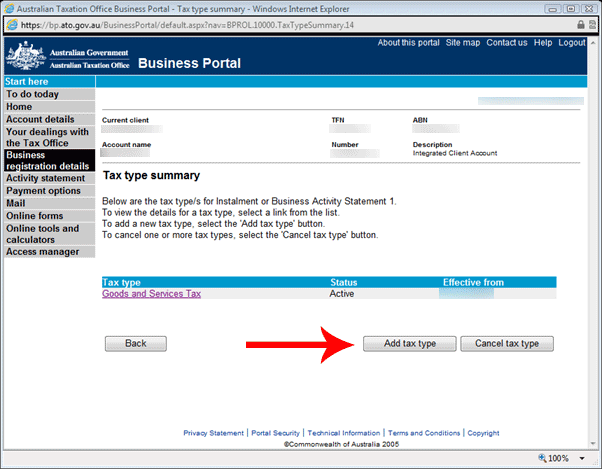

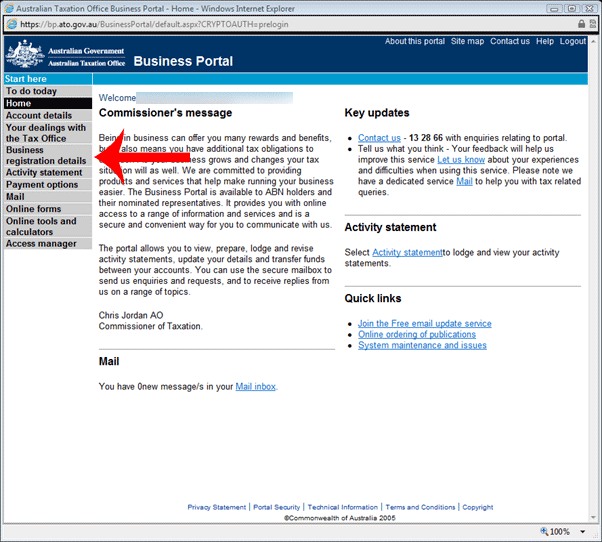

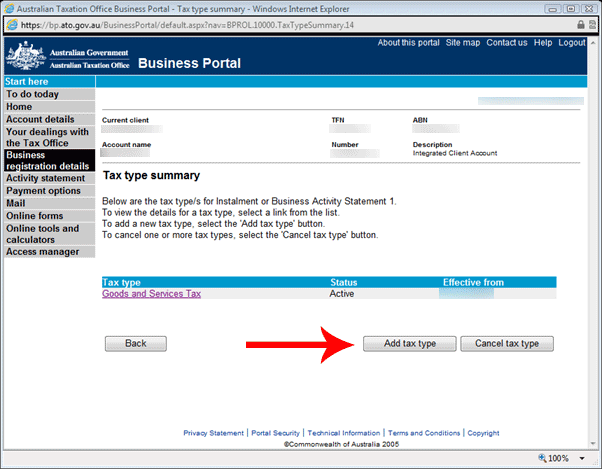

How To Register For Gst If You Already Have An Abn In Australia Hard Answers

Malaysia Sst Sales And Service Tax A Complete Guide

Pin By Uncle Lim On G Newspaper Ads Ads Corporate Design

Gst Registration Online Process Documents Fees Threshold

Enrichco On Twitter Accounting Services Success Business Business Format

How To Register For Gst If You Already Have An Abn In Australia Hard Answers

Registering For Gst Video Guide Youtube

Everything You Need To Know On Gst Registration For Foreigners Ebizfiling

Do I Need To Register For Gst Goods And Services Tax In Malaysia

Gst Change Of Address A Quick And Easy Online Process Ebizfiling

Point Of Sales System Malaysia Online Pos System Pos Terminal Pos Cash Register Restaurant Cloud Simple Pos System Pos Malaysia

What Is Gst Process To Download Gst Registration Certificate

Step By Step Guide To Apply For Gst Registration

Malaysia Sst Sales And Service Tax A Complete Guide

How To Register For Gst Gst Bas Guide Xero Au

Inventory Gst Invoices Accounting In 2022 Finance Apps Accounting Accounting Software